Stocks Drop With Earnings and Geopolitics in Focus: Markets Wrap

…

(Bloomberg) — European stocks and US equity futures fell Wednesday, with sentiment under pressure from concerns over stricter American trading curbs on China.

Most Read from Bloomberg

A slump in technology stocks led Europe’s Stoxx 600 lower, with Dutch chipmaking machine company ASML Holding NV tumbling more than 5% as worries about the potential of a more severe US chip crackdown on China offset higher-than-expected orders.

S&P 500 contracts dropped 0.5%, while those on the Nasdaq 100 slipped 0.7%. MSCI’s Asia Pacific Index pared gains, with semiconductor equipment maker Tokyo Electron Ltd. sinking on the US-China concerns.

The pound rose to the day’s high against the dollar and traders trimmed their bets on an August rate cut from the Bank of England after UK inflation came in above economists’ forecast. The Consumer Prices Index held steady at the BOE’s 2% target for a second straight month in June, but showed stubborn price pressures in the services sector.

Treasury yields ticked higher after their declines on Tuesday. The dollar was steady.

Optimism that the Federal Reserve will cut rates soon, alongside signs of US retail resilience, has supported risk-on sentiment in recent sessions, while the increasing chance of a Donald Trump presidency has raised concerns over geopolitical and trade risks.

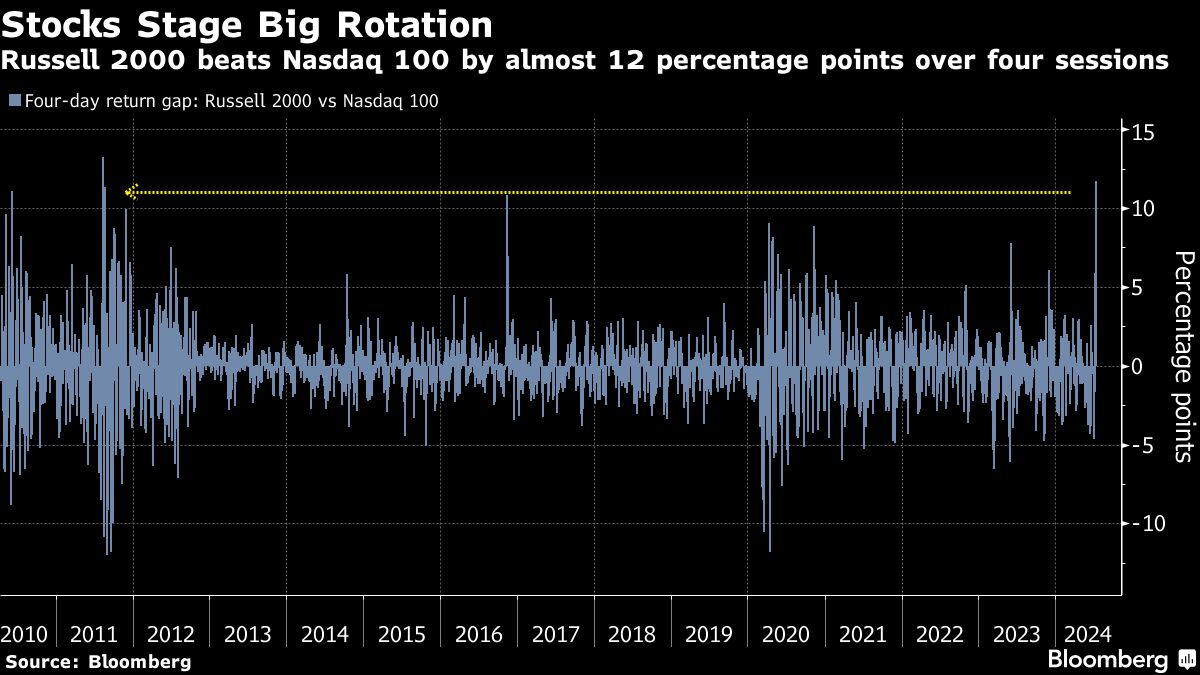

“We have a complex matrix of drivers,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. “Impending Fed easing ought to be good for rotation into smaller cap and tech, but equally, Trump 2.0 raises the uncertainty associated with geopolitics and trade.”

While the S&P 500 notched a fresh all-time Tuesday, there has been a rotation into smaller US stocks. The Russell 2000 Index rose 12% in the five sessions through Tuesday, its best showing since April 2020.

Key events this week:

-

Eurozone CPI, Wednesday

-

US housing starts, industrial production, Wednesday

-

Fed Beige Book, Wednesday

-

Fed’s Thomas Barkin speaks, Wednesday

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.3% as of 8:18 a.m. London time

-

S&P 500 futures fell 0.5%

-

Nasdaq 100 futures fell 0.8%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index rose 0.2%

-

The MSCI Emerging Markets Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0904

-

The Japanese yen rose 0.5% to 157.57 per dollar

-

The offshore yuan was little changed at 7.2843 per dollar

-

The British pound rose 0.1% to $1.2991

Cryptocurrencies

-

Bitcoin rose 1.2% to $65,499.86

-

Ether rose 1.4% to $3,488.26

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 4.17%

-

Germany’s 10-year yield was little changed at 2.42%

-

Britain’s 10-year yield advanced two basis points to 4.06%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.