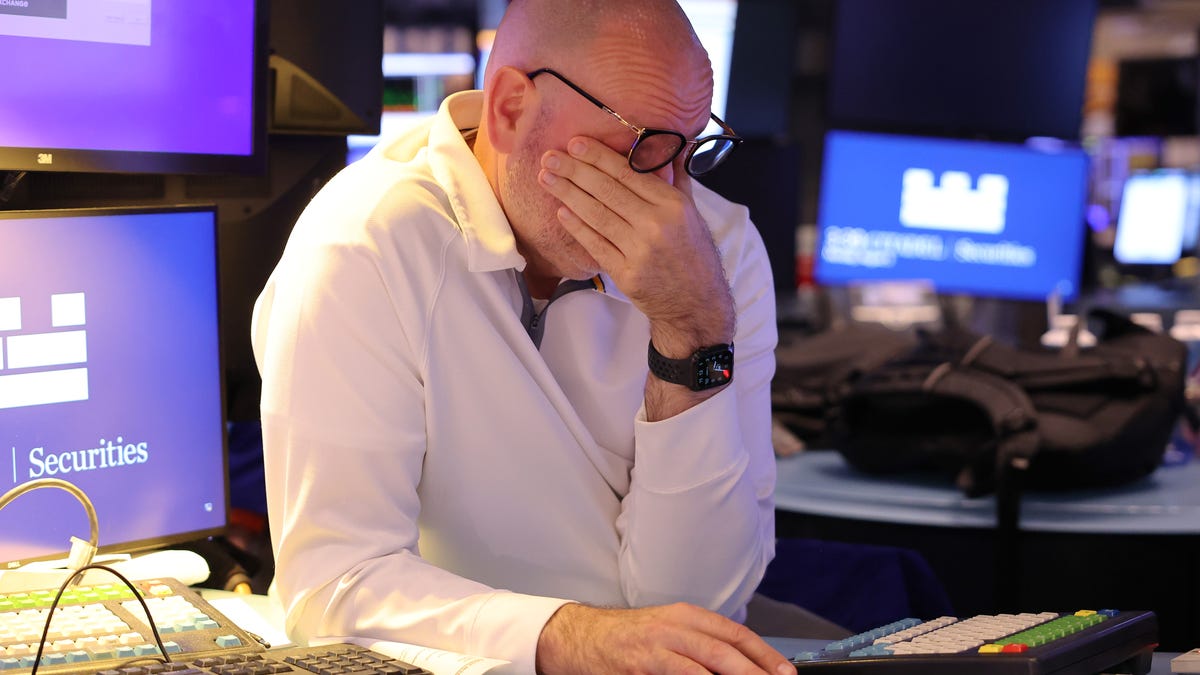

The Nasdaq and the S&P 500 slump as Biden’s new AI rules rattle Nvidia and other tech stocks

The Nasdaq and S&P 500 fell on Monday as a continued selloff in tech stocks extended losses sparked by stronger-than-expected job reports.Read more… …

In This Story

The Nasdaq and S&P 500 fell on Monday as a continued selloff in tech stocks extended losses sparked by stronger-than-expected job reports.

In the late afternoon, the Dow Jones Industrial Average added 0.78%, while the Nasdaq and S&P 500 dropped 0.7% and 0.07%, respectively. Meanwhile, the 10-year Treasury yield climbed to a fresh high of 4.77%. Oil prices also surged 3.4%, with West Texas Intermediate reaching $79.2 per barrel, marking their highest levels since early October.

Advertisement

This week holds significant events, including earnings reports from JPMorgan Chase (JPM+1.82%) and Goldman Sachs (GS+0.57%) on Wednesday, followed by Taiwan Semiconductor (TSM-3.47%) and UnitedHealth (UNH+3.93%) on Thursday.

Advertisement

On the macroeconomic front, investors will keep an eye on the key inflation indicators, the consumer price index (CPI) and producer price index (PPI), this week.

Advertisement

Nvidia fell following new AI rules

Shares of Nvidia (NVDA-2.69%) fell 3.7% on Monday as the Biden administration unveiled rules to regulate chip sales to foreign countries.

Advertisement

The White House published a swath of new guidelines early Monday to curb the sale of AI chips from U.S. firms such as Nvidia to specific countries and companies. The administration said the rules would “strengthen U.S. security and economic strength.”

Several AI-related stocks were also down, including Super Micro Computer (SMCI-5.29%), Micron (MU-4.73%), and Palantir (PLTR-4.61%), with declines of 10%, 5.7%, and 4.3%, respectively.

Advertisement

Moderna plunges 23% following earnings

Shares of biotechnology company Moderna (MRNA-17.58%) plunged more than 23% after the company slashed its sales guidance for the year. Moderna now projects 2025 revenue between $1.5 billion and $2.5 billion, a significant downgrade from its earlier forecast of $2.5 billion to $3.5 billion posted in September.

Advertisement

Lululemon jumps on revenue outlook

Shares of Lululemon (LULU+1.15%) surged 2.5% after the company raised its fourth-quarter earnings and revenue outlook, citing stronger-than-expected performance during the holiday season. The retailer now anticipates sales between $3.56 billion and $3.58 billion, up from its previous forecast of $3.48 billion to $3.51 billion. The update is a positive development for investors, as the athletic apparel company has faced sluggish sales over the past year.

Advertisement

Trump Media stock surges 21%

Shares of Trump Media & Technology Group (DJT+22.39%) spiked one week before Donald Trump is set to return to the White House for his second term in office.

Advertisement

Trump Media stock surged more than 21% on Monday afternoon, trading at $43.17 per share. That’s among the largest single-day jumps in the company’s share value since Trump won the presidential election.

In the time since Nov. 5, shares of the company — which owns Trump’s right-wing social media platform, Truth Social — have climbed 21%. Despite stocks and cryptocurrencies rallying following Trump’s election victory, Trump Media shares, which had become something of a proxy for Trump’s election odds, had a surprisingly muted response to the election results.

Advertisement

— Rocio Fabbro contributed to the article